As our debt increases dramatically and entitlement spending increasing beyond our means, something has to be done. President Obama is content to play the race card in an attempt to gain a second term. His plan to "fix" the spending problem in this country is not a viable long-term solution.

Medicare and Medicaid are much, much more expensive than originally slated. President Johnson signed the act creating these services claimed that they would be efficient and relatively cheap. Let's take a look at the estimates and reality:

Medicare (hospital insurance). In 1965, as Congress considered legislation to establish a national Medicare program, the House Ways and Means Committee estimated that the hospital insurance portion of the program, Part A, would cost about $9 billion annually by 1990.v Actual Part A spending in 1990 was $67 billion. The actuary who provided the original cost estimates acknowledged in 1994 that, even after conservatively discounting for the unexpectedly high inflation rates of the early ‘70s and other factors, “the actual [Part A] experience was 165% higher than the estimate.”

Medicare (entire program). In 1967, the House Ways and Means Committee predicted that the new Medicare program, launched the previous year, would cost about $12 billion in 1990. Actual Medicare spending in 1990 was $110 billion—off by nearly a factor of 10.

Ronald Reagan said about the system: “[I]f you don’t [stop Medicare] and I don’t do it, one of these days you and I are going to spend our sunset years telling our children and our children’s children what it once was like in America when men were free.” When you look at the debt being accumulated by future generations, this is beginning to ring more and more true.

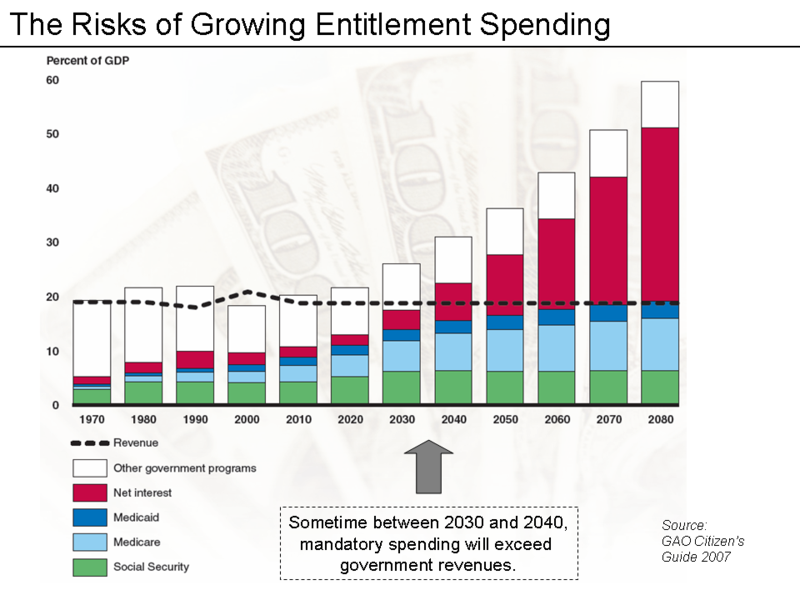

The country is facing a structural debt crisis. As the aging population grows in proportion relative to those who are able-bodied and working, there is a severe problem. Without swift action, we are in severe trouble.

Let's take a look at Federal spending last fiscal year:

Medicare and Medicaid combined equal 23% of our total budget, or approximately half of our deficit. This is larger than our entire defense budget. Also keep an eye on the yellow bloc, which represents the interest on our existing debt. This is now greater than the entire budget deficit in 2007-- when George W. Bush was President.

If you then take a look at where the program is headed as the Baby Boomers are retiring, we have a horrible outlook:

If we look at the structural debt problem form this angle, it becomes clear that something has to be done. However, Democrats in Congress will instead shriek that any attempt to reform or change the system would wind up "destroying" the problems.

So let's take a look at some of the problems facing the programs today:

- Medicare and Medicaid both increased the cost of medicine in this country. As people went to the doctor more and more for non-essential services, the cost of treating them has increased. The medical rate of increased costs well outpaces that of the inflation rate. Much of that is because of the artificial forces of the two programs.

- Medicare and Medicaid fraud is a constant concern. This cost New York State alone over $1 billion last year and the federal government of $54 billion!

- Non-citizens are able to draw from the Medicaid pool.

- With the Baby Boomers retiring, we have drastic changes to the demographics of the country. Today we have almost four workers paying in for every Medicare beneficiary. Within twenty years that number will drop by over one-third. Today, we have about 13% of the country 65 years and over, or about 38 million people. This number is expected to increase greatly the next twenty years.

For the third major option, we can take a look at what has happened in Indiana under Republican Governor Mitch Daniels. Not wanting to play into socialism but still wanting to slice the amount that the state paid for insurance costs-- he came up with a middle ground. The Healthy Indiana Plan is a waiver system meant to not interfere in individuals' lives, but instead use very subtle methods, including waivers, to help fix the system. Daniels would balance Indiana's budget.

And you can't just get it for free-- you have to pay in additionally.

To obtain and maintain coverage, enrollees must make monthly POWER Account payments, which are scaled by family income and range from 2%-5% of income. The state (along with federal match funds) pays for the gap between enrollees’ payments and the $1,100 deductible for the POWER Account. If an enrollee misses a monthly payment, the individual loses coverage, forfeits 25% of his or her POWER Account contributions, and is barred from re-enrolling for 12 months. By obtaining state-specified preventive care, enrollees can carry over state POWER Account contributions to the next year, which helps offset required enrollee payments.This plan wound up being budget-neutral while also cutting Medicaid expenditures. This is an improvement on the other potential plans circulating around the country. So why don't we use some of the ideas of Governor Daniels combined with a very simple enforcement policy.

The plan: create a new medical voucher program to replace both programs. Obviously they would have to be phased out, but the new idea would be devilishly simple.

Use the funds collected in payroll taxes to instead create an annual voucher to feed into an individual medical account. This account would allow people to use it as they wish-- for any medical expenses. This account would accrue interest, say, at a 2% rate or whatever else the prevailing savings rate would be. Every citizen, of any age, would receive $2,000 annually into the account. For those that would complain about 'helping' people making over $250,000 a year, even if you cut them out it would not be a great difference in spending (about $3 million annually).

This account would be good for Republicans because it would be much cheaper and simpler to use without smacks of socialism. For Democrats, the amount of money given per money earned would be disproportionately higher for seniors, the poor, and children.

Childrens' accounts would be under the jurisdiction of their parents. This way, the parents would not have to pay out of their own account to pay for health care for their children.

Those who are in good health in their teens, twenties, and thirties, would likely not use much of their account. Then the account would simply feed into itself and keep growing without interference. That way, over 30 years it would increase $60,000 (plus interest) without major withdrawals. By the time a person starts getting major medical bills in their 50s they could have $100,000 in the account. By the time a person is a senior, they will have tens of thousands of dollars to deal with increasing costs and end-of-life services. When a person dies this money would return back to the government coffers.

This system would automatically increase with the rate of inflation not the medical cost rate. This way, spending would remain constant every single year in terms of real dollars. Further, there would not be an artificial excess of money that would drive up medical costs. If people want to use the money for pointless optional procedures, then they could do it without billing the government.

This would not be a medical insurance program. The government would not mandate to buy any insurance, or for that matter, and medical care at all. People could use the money from the account to buy their own insurance from a company at market prices. They could choose to be uninsured and only use the account when they believe it necessary. This way the government would be able to leave the choice of what to do with your own account in your own hands. The poor would be benefited with a way to cover both insurance and other costs.

Many private and public employers already use health-flex plans to pay for individuals' personal medical care. This would be an extension that could be used in tandem with insurance earned from work

Now, let's take a look at the result on the individual:

At the age of 21, a person that used 1/4 of the funds in the account while earning 2% annually in interest would have (these numbers would be rated for inflation in an actual scenario):

$37,174.98 in the account at taxpayer cost of $42,000. If that person then used zero dollars in the account over the next 25 years he or she would have an amazing: $126,331.31 at the age of 46. This is at taxpayers' expense of $92,000. Then for the next nineteen years until retirement the person uses half of the annual funds. By retirement this account would have: $207,338.23 at the beginning of the golden years. This is at taxpayers' expense of $130,000. This over $200,000 could be used to buy private insurance or supplement one already earned. Furthermore, medical expenses would not have to come out of pensions or personal savings-- but instead an account specifically meant for health care.

This plan does not discriminate by income or pre-existing conditions. It would cover 100% of Americans and would not go bankrupt by an aging population. Furthermore, it would change along with inflation and only increase in costs because of a growing population. A growing population would likely have more people to pay into the system.

So with this system to total amount being paid for Medical Vouchers would be $616 billion dollars. Doesn't sound like a real improvement-- only a $177 billion savings. Twenty years from now the cost for the Voucher program would be about $700 billion (adjusted for inflation)-- a minor increase for a projected population of 350 million. However, the country would be looking at much higher amounts with the current numbers. It's unclear how much would be spent just on these two programs, but a middle-of-the-road figure would be about 10% of GDP-- or $1.4 trillion in 2011 dollars. This would mean that we would save a full 50% of costs-- and perhaps give better, more personalized service. Not to mention the money returned to the government after death.

Think of all of the claims adjusters that this country would not have to pay for. Think of the elimination of all fraud-- everyone would get the same amount. Think of the reduction of health care costs as artificial metrics are thrown out.

We have two doctors writing for the site-- let me know what you think. Would this plan work in the real world?

Please bookmark!

No comments:

Post a Comment